Blog

Automated Clearing House (ACH) versus pay by bank

March 22, 2023

Editorial Team

The ACH network was founded in the 1970s as a replacement for checks payments. Short for Automated Clearing House, ACH is the most ubiquitous payment rail in the US—over 93% of American workers get paid via direct deposit, a type of ACH transaction.

ACH payments are typically low-cost, fast, and secure, making them an ideal payment method for both individuals and businesses. ACH payments can be initiated by individuals or businesses for one-time or recurring transactions.

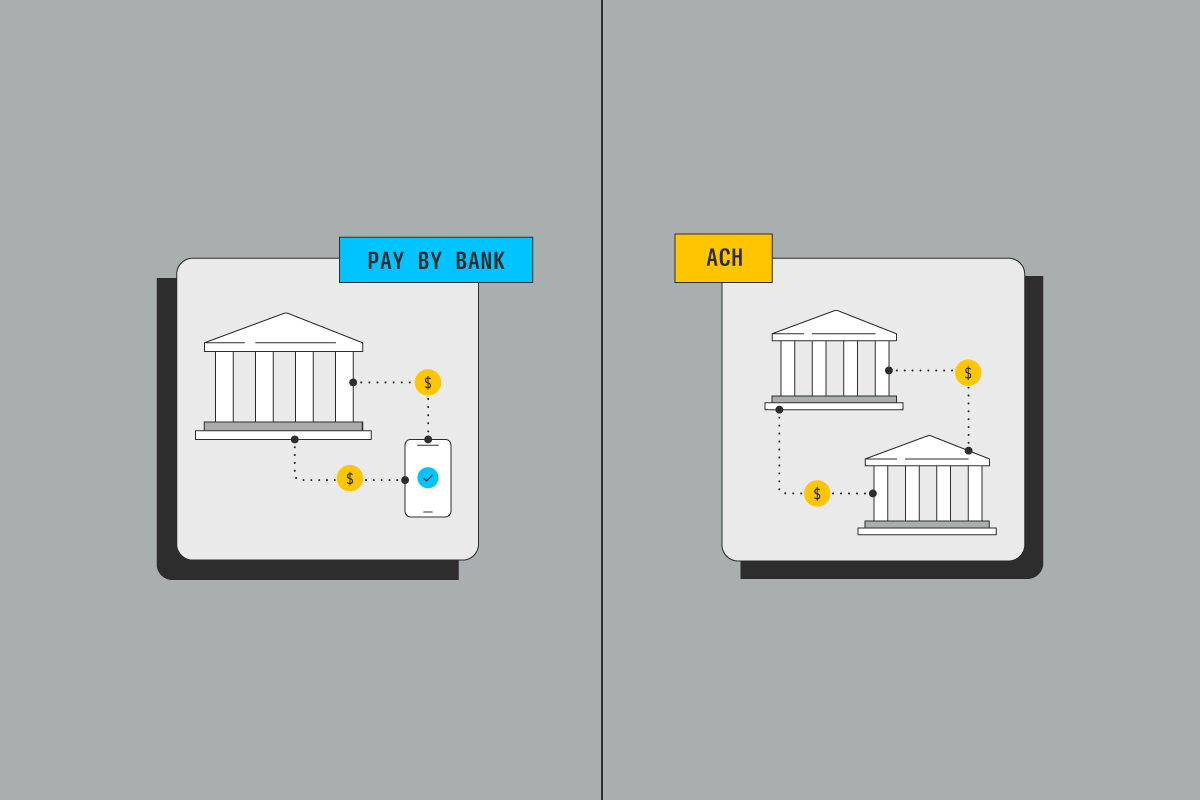

Other payment methods, like pay by bank, actually operate on the ACH rails combining the security and reliability of ACH, with the convenience of an electronic interface. In this article, we’ll dive into two popular payment methods: ACH and pay by bank and learn more about how these two methods work, their benefits, and their differences.

ACH payments: what is it, and how does it work?

ACH payments are a type of electronic payment that use the Automated Clearing House network, a payment rail, to securely transfer funds from one bank to another. ACH connects all the financial institutions in the US for the secure transfer of funds.

ACH is widely used in the US. Since 2013, the value of ACH payments has grown by at least $1 trillion each year, and 30 billion transactions were made in 2022 alone.

ACH payments can include payments made from one individual to another, business to business, direct deposit, and even bill pay.

These payments are typically low-cost, especially compared to payment methods such as cards and wire transfers.

They’re also convenient as transactions are made from one bank to another without using physical objects such as cards or checks.

ACH payments are handy for recurring payments, as individuals can set up automatic transactions through their bank accounts for bill payments, which lowers the chances of late or missed payments.

ACH payments are usually processed in batches every day, and the network allows transaction processing on any business day. Businesses can collect payments directly from the individual’s bank account when they have the customer’s account number and bank routing numbers. To set up direct debit transactions, individuals need to provide their account details, along with the routing number, and authorize transactions from the business so payment can be processed, be it recurring or one-time payment.

Payment processing systems within the ACH network

There are many payment processing systems in the ACH network:

Federal Reserve is the largest ACH payment processor in the network; services include settlement and clearing of transactions. The Federal Reserve was created by an act of Congress. The governors of the Federal Reserve are appointed by the President of the United States and confirmed in the Senate.

National Automated Clearing House Association (Nacha) is a non-profit responsible for managing and regulating the ACH network and its payments. Nacha regularly updates its rules to ensure security and protect customers, as it recently did in 2023.

Third-Party Payment Processors include fintech companies like PayPal and Stripe. TPPs offer payment processing services to businesses and individuals through various methods, including ACH payments.

Banks and credit unions often offer ACH payment processing services to their customers through their proprietary systems or partnerships with payment processors.

ACH payments are generally known for their secure, efficient, and fast processing of transactions. To learn more about the various processing systems, check out Link Money’s open banking glossary.

Steps involved in ACH payments

The specific steps for ACH payments vary based on the payment processing system, but in general, include the following steps:

Authorization: The payee authorizes initiating a transaction by sharing the bank account and transaction details with the payer.

Initiation: The payer initiates the transaction by entering the account and transaction details into a payment processing system or by creating an ACH file.

Processing: The payment processing system will share the details through the ACH network, which routes the payment to the receiving financial institution. It takes about 1-2 business days for payments to be processed.

Settlement: This is when the payment is settled between both banks, and funds are transferred from the payer’s account to the payee’s account, usually within 2-3 business days.

Confirmation: Both parties receive payment confirmation, typically through email or a payment processing system; the transaction is also noted in each party’s account statements.

Considering the security and efficiency of ACH payments, it’s no surprise that they make up a significant portion of all transactions in the US. For example, ACH payments include payroll transfers, income tax refunds, social security benefits payments, mortgage, utility, and credit card payments. But ACH never took off as an online payment method. Let’s see how pay by bank can change that.

Pay by bank: what is it, and how does it work?

Pay by bank is an electronic payment method that uses an application programming interface (API) so consumers can make payments directly from their bank account to a merchant through their bank’s online platform, without needing account and routing numbers, or a credit or debit card.

In the US, pay by bank actually operates on ACH rails, with a layer of open banking to make transactions faster, easier, and more secure. Customers can use pay by bank for everyday purchases online as well as recurring subscriptions by choosing the option at checkout.

Usually, once a transaction has been initiated online, the payer will be redirected to their bank page, where they’d have to authenticate their identity and grant access to the bank account. The key difference to note here is that an individual's bank details, such as username and password, are not shared with the merchant. Rather, they’d be granting access to the bank account for the payment without the login details.

For example, when you create an account with an online site like Etsy by signing into your Google account, you’re not sharing the login details but merely creating a connection between your Google account and Etsy. Etsy has access to your email, but nothing else without your consent.

The verification process is done through an individual’s login credentials or biometric authentication.

This (usually one-time) process grants the third-party provider or merchant a connection to your bank account and shares your approval to facilitate the transaction by relying on open banking technology.

As mentioned earlier, pay by bank often runs on ACH rails in the US, so transactions are processed in batches on business days. The speed at which transactions get processed depend on the financial institution, type of transaction (one-time or recurring), and when the transaction was initiated.

Pay by bank is rapidly growing globally. Right now, it’s new to the US, but fintech companies like Link Money pave the way by helping merchants benefit from using pay by bank for their transactions. Pay by bank benefits both consumers and merchants:

Consumers have a secure and convenient way to make payments without using physical objects like cash, card, or checks, which carry a higher risk of fraud.

Merchants have a secure and cost-effective way to accept payments, as pay by bank has lower transaction fees than traditional card payments. Pay by bank also improves the overall customer experience which can contribute to customer retention.

For pay by bank transactions to take place between a consumer and merchant, there are several parties involved in the process:

Consumer: The individual who initiates the payment and confirms their identity through the online platform, often when they log in or through biometric.

Merchant: The business or organization that uses pay by bank to receive the payment. Usually, the pay by bank option is part of the checkout process, where consumers can grant access to their bank accounts (without sharing their username or password with the merchant) to make payments directly to the business.

Banks: Includes the consumer’s bank account, where the funds are verified and transferred, and the merchant’s bank account, where the money is received.

Payment service provider (PSP): Also known as third-party payment processors (TPP), PSP is the intermediary between the merchant and the bank that facilitates the transaction and ensures that it is secure and accurate. PSPs may facilitate the transactions directly or through a data access network (DAN). In the US, ACH sometimes serves as a PSP for open banking transactions.

It’s important to note that PSPs usually hold contracts with banks and institutions to process payments and collect funds. Likewise, payment gateways typically have an agreement with the merchant.

Steps involved in pay by bank transactions

Pay by bank is often used in e-commerce and subscription-based transactions. There are several steps involved in these transactions, although they could vary depending on the context. In this section, we’ll explain how direct debit works:

Checkout: The customer selects “pay by bank” through the website or app to pay the merchant.

Bank verification: The customer grants access to their bank account without sharing login information to authenticate their identity and verify that funds are available. At this point, the customer will have to log in to their bank account from a known device to verify their identity, or select one of the multi-factor authentication options after login, like a one-time passcode or a PIN, if they’re signing from an unknown device. This step prevents fraud and ensures that only the account holder makes the transaction.

Authorization: Once the customer has verified their identity, they authorize the payment amount and the merchant details.

Payment processing: After the payment is authorized, it is processed and the funds get transferred from the payer’s bank account to the merchant’s account. This can take several hours to days, depending on the financial institution, the time the transaction was initiated, and whether it’s a business day.

Confirmation: The customer and merchant receive payment confirmation through a text or email, and the bank records the transaction in both parties’ account statements.

Ultimately, pay by bank offers consumers a convenient and safe way to make payments, while merchants can lower the risk of fraud and ensure the funds get transferred.

Traditional ACH vs. pay by bank: a side-by-side comparison

The following table offers a side-by-side comparison between traditional ACH and Pay by Bank with a few points of reference in mind:

Choose the best payment method according to your needs

Ultimately, the choice between ACH and pay by bank will depend on the specific needs and priorities of the business or individual. You might already be considering or using ACH debit for your day-to-day business transactions. In that case, using an open banking partner can streamline the payment process for you and your customers. With an open banking partner, you benefit from enhanced security and faster processing times. Moreover, you can offer a better user experience for your customers, which can improve your bottom line.

Link Money offers merchants a safe and speedy way to verify customer identities and collect payments through pay by bank.