Use Case

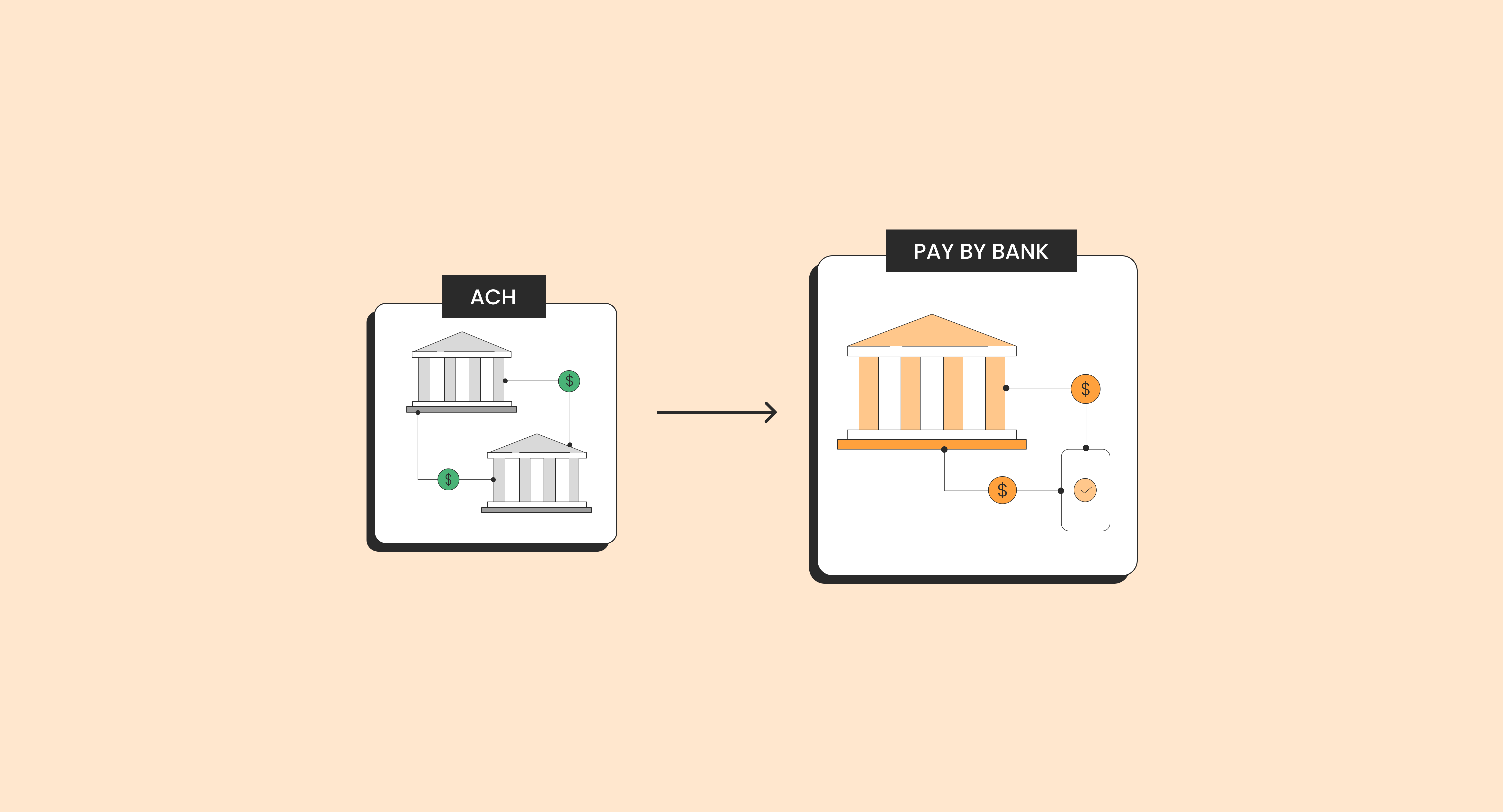

Shifting ACH to Open Banking

September 11, 2024

Narciso Munoz Legarre

Automated Clearing House (ACH) is a network that processes electronic financial transactions – such as direct deposits and direct payments – for consumers, businesses, and federal, state, and local governments. You can think of it as rails to make payments (Credit cards, for instance, use different rails.) If you signed up to get your paycheck directly deposited by your employer, you are getting a credit using the ACH rails. Some merchants or service providers may let you also make payments using ACH. Link makes these payments seamless and easy.

What?

ACH money movement is one of the oldest and least expensive ways for merchants to collect payments from their customers. Traditional ACH payments continue to become more rare in the B2C space because of a couple key factors that affect merchants and their customers. Money movement is not immediate, high friction when collecting payment details, micro-deposits delay payment onboarding, and merchants face high return rates as well as fraud. Open Banking technology is built on the premise that bank data should be accessible for the consumers benefit and with their security in mind. Link Money leverages Open Banking to build products that look to preserve all the benefits of ACH payments while eliminating the drawbacks.

Why use ACH?

The benefits of ACH payments via Open Banking are clear and measurable when considering a new customer: Reduced friction providing payment details: as simple as a faceID or fingerprint scan at major institutions. Immediate decisioning: Subsecond covered returns and significantly reduced fraud. The benefits of transitioning an existing ACH customer are less apparent but equally impactful. Reducing man hours on returns, data security and platform uniformity will impact your bottom line and peace of mind. Open banking enables merchants to know if a transaction is likely to be returned before submitting a payment request and additionally provides insights that enable automated retries with a high success rate, significantly decreasing time spent on attempting to capture funds and reducing the customer churn. Storing customer information as delicate as an account and routing number comes with serious responsibility and security risks. Switching to ACH payments through open banking would unburden the liability of storing and handling customer PII. To maximize the benefits of shifting to ACH through open banking it is key to consolidate all customers through the same process to avoid redundancy and optimize resources. Link Money products work to facilitate this transition.

How?

Link Money’s product suite can facilitate a transition at various levels of merchant integration depth. If the intention is to leverage Link Money as a payments platform the starting off point is integrating 1 API; the most common transitions are outlined below.

Moving an existing ACH customer base to Link Money:

Provide a list of existing ACH details and receive a tokenized customer list that can be used to create payments via a simple API.

Leverage dynamic links to transition customers to Open Banking. Small incentives have shown to be very effective in converting an existing ACH book into Pay By Bank (PBB).

As customers transition to PBB, Link Money will continue to process both traditional and PBB ACH into a single payment service. No need to carry two processes side by side.

Onboarding new customers:

If you are onboarding customers through your website, the Pay by Bank product can be surfaced off of one API.

Link Money additionally offers the Dynamic Links product for out of session use cases where merchants can generate and send SMS or email links that customers can use to connect accounts to PBB. Tokens that can be used to initiate payments are returned to the merchant.