Blog

We raised $30 million and launched LinkPay: Saving merchants up to 70% on payment processing fees

January 19, 2023

Eric Shoykhet and Edward Lando

Processing credit and debit cards cost merchants 1.5 to 3.5% for each transaction. Steep interchange fees are destroying bottom-line profits for merchants. Markets outside of the U.S., where cards are less the norm, have a robust open banking infrastructure. In the E.U., for instance, 45% of all consumer electronic payments are bank-based.

The U.S. has largely lagged behind at the expense of business profitability – until now.

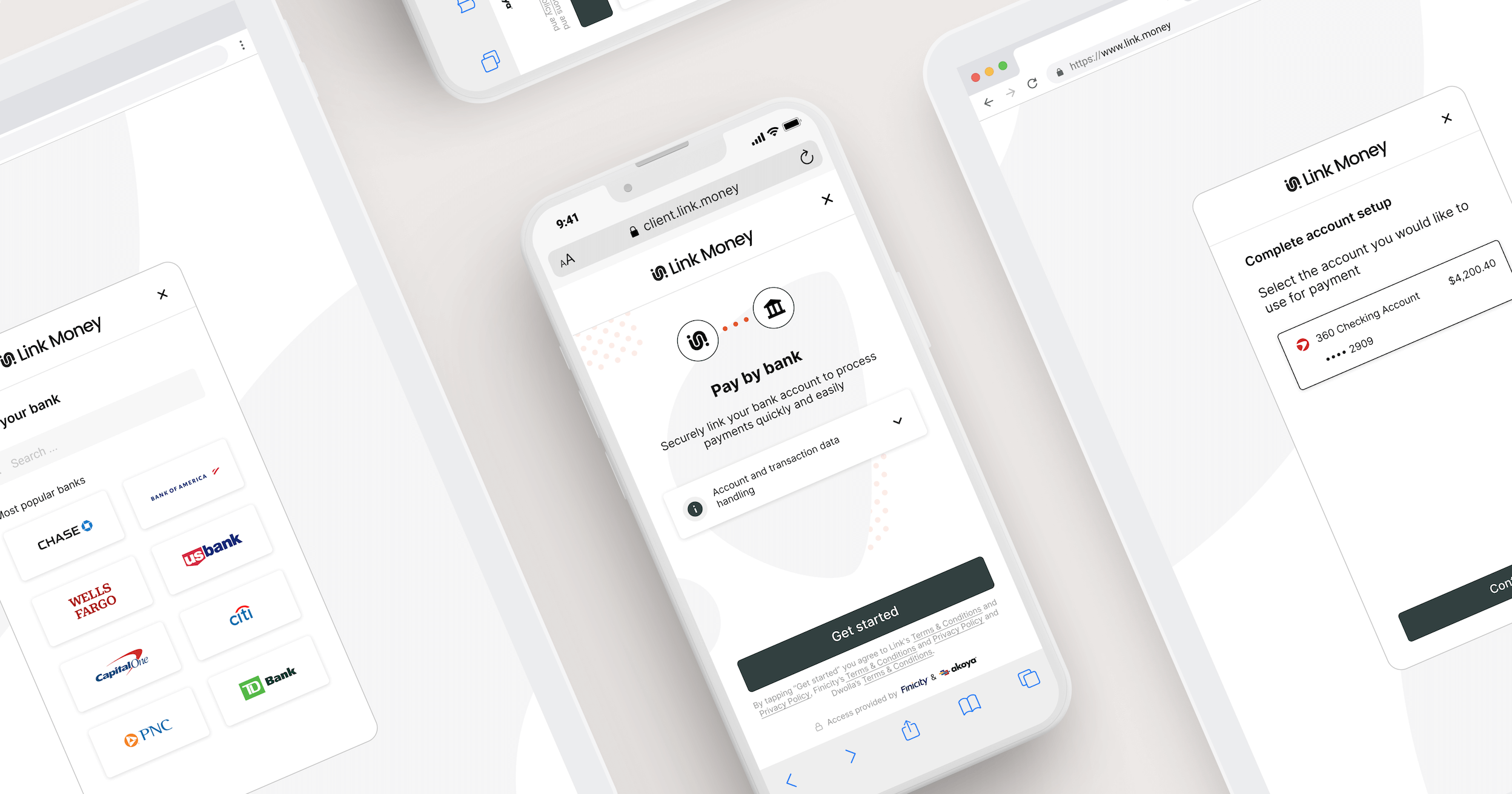

Today we’re excited to unveil LinkPay, our flagship product. It’s the first open banking-powered payment solution focused exclusively on the U.S. that enables consumers to make digital payments using their bank accounts. LinkPay is currently live and already has several billion in payment volume committed from enterprise merchants such as Misfits Market, Thrivos, Play by Point, and Passport Inc. Shopify merchants such as Beddy's, KimC Market, Bausele, and Overeasy have been able to turn on LinkPay within minutes using our Shopify App.

By utilizing the ACH Network and proprietary machine learning technologies, LinkPay delivers a low-cost and secure payment alternative that provides:

Savings: LinkPay lowers transaction-related fees for merchants by up to 70% compared to credit and debit cards, and even more for other payment methods. On average, Link merchants save 2% of the amount of each transaction.

Fraud-reduction: reduces fraud through strong consumer authentication that minimizes the risk of unauthorized transactions and, as a result, cuts down on reversals.

Compliance: leverages security at the forefront – Link is SOC 2 certified and ISO 27001 compliant.

Increased sales and reduced churn: allows customers to connect their accounts once, and keep paying, thereby reducing churn for merchants with subscriptions and repeat purchases. Bank accounts are subject to less switching and cancellation than credit and debit cards, and they don’t expire.

Robust banking coverage: partners with a majority of banks and credit unions in the U.S., which today includes ~95% of all bank accounts.

Backed by $30M in funding to fuel our next phase of growth

We’re excited to share that Link has raised $20M in Series A funding led by Valar Ventures. This follows $10M in a previously unannounced Seed funding round led by Tiger Global with support from Amplo, Pareto Holdings, Quiet Capital, and angel investors that include the founder & CEO of Shutterstock, Jon Oringer. In total, Link has raised over $30M in the last year from investors that understand the transformative power of our payments technology.

“Link is bringing the power of open banking to the payments space for the first time in the U.S. The company has the potential to redefine digital payments for consumers and empower businesses to save on costly payment processing fees,” said Andrew McCormack, Partner, Valar Ventures. “With an experienced team of talented entrepreneurs behind the company, we invested in Link because we believe they’re at the forefront of a better, more efficient financial system.”

Over the course of the past year, we've launched our product, attracted notable merchants, and doubled our team from 20 to 40 employees. Our team is composed of serial entrepreneurs with a proven track record of launching successful companies across the payments, legal, and cybersecurity space. In prior experiences, we’ve suffered through the pain points that we’re currently focused on solving at Link. This gives us a deep sense of commitment to our mission and the desire to bring about a more cost-efficient payments ecosystem.

U.S. Consumers spent $1 trillion online in 2022, costing merchants $25 billion in fees and resulting in $20 billion in fraud. This cost burden is the highest in the world and ultimately gets passed on to consumers. If LinkPay were used for 10% percent of online transactions, merchants would save $2.75 billion dollars a year. At Link, we believe that it’s time for American businesses and consumers to have better, more cost-efficient options to pay.

In a world where 71% of U.S. consumers said they would like to be able to make purchases or pay bills directly from their bank account, we’re here to make this a reality. If you are a merchant, developer, or product manager who wants to quickly integrate LinkPay into your payments experience, please contact us to schedule a demo with our team.

About open banking

Open banking is the concept that banking data is much more useful if it is accessible to third parties — under a high level of security and with the explicit permission of account holders. With regards to digital payments, this means that bank account holders are able to make payments directly from their account to another account, with only an open banking provider such as Link Financial Technologies needed to facilitate the transaction. The simplicity of this process translates into lower costs, greater security, and more convenience for merchants and consumers alike.