Blog

100 million+ American consumers could benefit from pay by bank

August 27, 2024

Editorial Team

If you’re reading this, you almost certainly have at least one credit card, possibly several, and there’s a good chance it’s your primary payment method.

In the U.S., it’s hard to see how else things could work, as it’s so integrated into credit scores, offered through virtually every online and offline checkout, and in some cases is even used to fund other payment methods like wallets and BNPL. In short, credit cards are deeply embedded in our commercial culture.

However, as economic conditions shift, consumer debt reaches record levels, and technology produces better options, it’s becoming clear that other payment options are more suitable for certain transactions, or even types of consumers. In fact, several significant demographics — easily numbering over 100 million — are in serious need of other payment options.

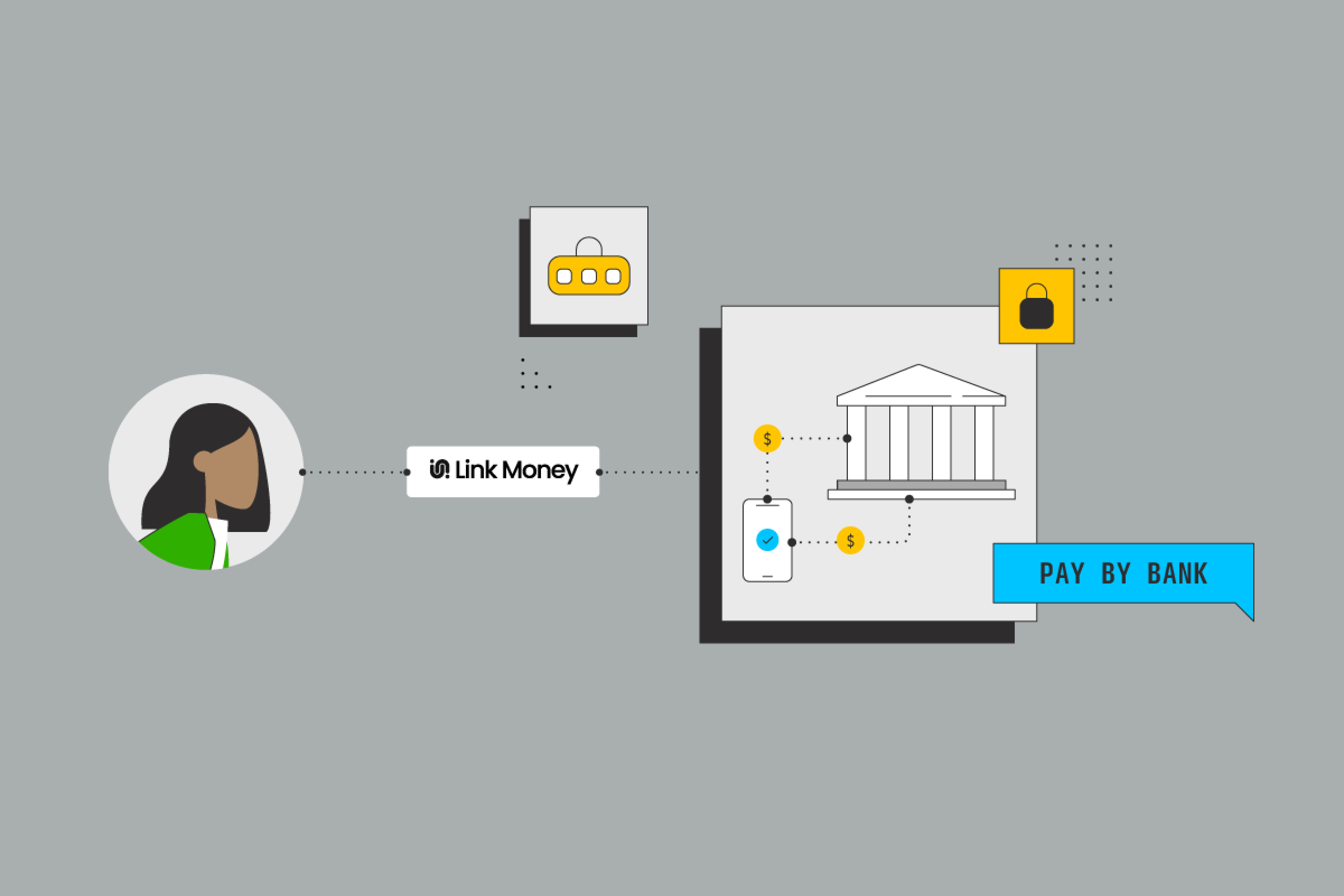

A brief intro to pay by bank

Pay by bank is a payment method that lets customers pay for goods or services directly from their bank accounts, with no card or credit involved. High security, low transaction fees, and convenience, make it an interesting alternative to other payment options — especially for those who prefer not to or can’t use credit cards.

Let’s take a look at the key demographics who stand to benefit from paying with their bank!

1. High income consumers managing their credit availability

Perhaps counterintuitively, households with an annual income of $100,000 or more are more likely than lower income households to have been in debt to their card provider for at least a year and for at least five years. Since pay by bank makes it impossible for consumers to go into debt, it can be a very effective payment method to help higher-income earners manage their credit availability, and thereby keep a good credit score.

2. Consumer with high debt loads and/or low FICO scores

U.S. consumers collectively owe a staggering $1.14 trillion in credit card debt. This burden is not just a number; it’s a source of stress for millions of Americans. Nearly three in four Americans (73%) believe credit cards make it challenging to manage their finances. With interest rates and fees piling up, many consumers are finding themselves trapped in a cycle of debt.

Moreover, while many people want credit cards for the rewards, over 30% of Americans have a FICO score under 669, meaning they don’t get the same benefits from their card, and potentially pay more interest. For this group, pay by bank offers a much-needed alternative — a way to pay directly from their bank accounts without accruing additional debt or fees, and with no penalties on rewards.

3. Consumers with longer-term debt who struggle with high APR

For many higher-income earners, long-term debt with high interest is an unnecessary nuisance. But for a significant portion of the U.S. population, credit card debt is a real long-term financial struggle. Approximately 56 million Americans have been in credit card debt for at least a year, with nearly half of all credit card holders carrying debt from month to month. And this has coincided with the highest APR on record. Over the past two years, credit card rates have increased by 500 basis points, reaching a record of 22.76% on average in May 2024.

This persistent indebtedness can lead to financial instability and a sense of helplessness, with high APR adding to the stress. For these consumers, pay by bank could provide a path to greater financial control, allowing them to avoid the pitfalls of revolving debt, and even help them focus on paying down their balances without the constant pressure of paying off interest.

4. Gen Z

Debit cards are the most popular payment method for Gen Z, with 69 percent using a debit card at least once a week, while only 39 percent frequently use credit cards (compared with 51 percent of other U.S. adults).

While credit is seen as an important tool to build credit scores, one in seven Gen Z credit card users are ‘maxed out’, indicating financial stress. Moreover, a significant portion of Gen Z doesn’t even qualify for credit cards due to insufficient income or credit history. Using pay by bank alongside their credit cards can help Gen Z consumers build their credit scores, while also maintaining control over their debt levels. And with a population size close to 70 million, that is a big consumer group to tap with a payment method that doesn’t add to their financial stress.

5. Credit-invisible consumers

Another critical group that stands to benefit from pay by bank is the “credit invisible” population — those who have no credit history at all. About 26 million Americans, or 11% of the adult population, fall into this category. However only around 13 million are unbanked, meaning there are many millions of consumers who cannot pay by credit, but can pay by bank.

People of color, particularly Black and Hispanic Americans, are disproportionately represented among the credit invisible, with 15% of these groups lacking a credit history compared to 9% of white and Asian Americans. For these individuals, traditional credit cards are often out of reach, making alternative payment methods like pay by bank not just convenient but necessary. This method allows them to make purchases without the barriers imposed by a lack of credit history.

The latent need for options like pay by bank is huge, and growing

You’re probably not going to get rid of your credit card soon, but payment trends can evolve quickly — just think of how fast the adoption of wallets and BNPL has been over the last decade.

For well over a hundred million U.S. consumers, relentlessly using their credit cards is not the best option, particularly as a potential recession looms and control over spending becomes more critical. Pay by bank presents a compelling alternative, not just to credit cards, but also BNPL and wallets — a low-cost, convenient, and secure way to pay that ensures consumers live within their means by default, as well as which saves merchants money on processing fees.

Want to learn more about pay by bank? Get in touch!