Blog

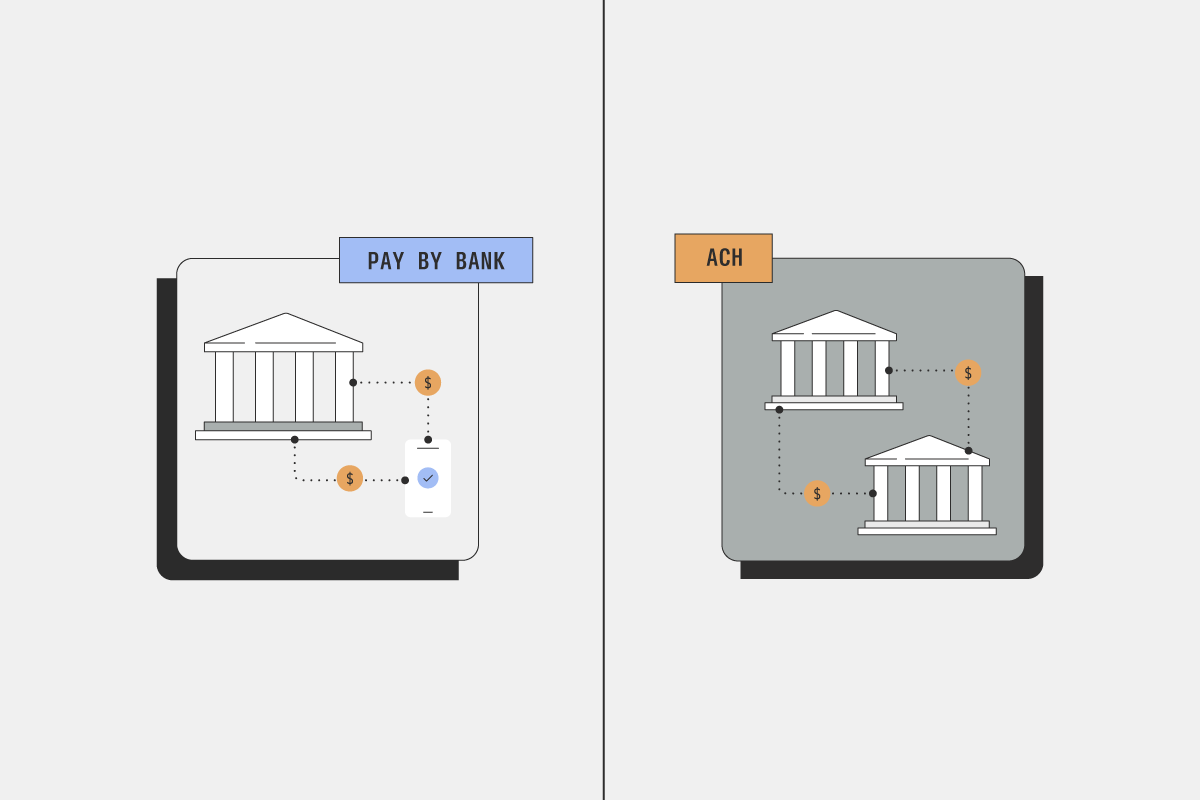

Pay by bank vs ACH direct debit: What is best for my business?

June 28, 2023

Editorial Team

Link Money - Pay by Bank is a method of open banking payments that lets customers pay for goods and services using their bank account.

A key unique selling point of Pay by Bank is that it has drastically lower processing fees for merchants — up to 70% lower than credit card fees, which means US merchants have the potential to save up to billions of dollars a year in overheads if it is adopted at scale. Pay by bank is able to offer such low processing fees because its transactions run over the ACH network, rather than credit card networks.

But it also raises the question: if ACH rails are so cost-effective and secure, why shouldn’t merchants use ACH Direct Debit instead of Pay by Bank? After all, there are many similarities between the two. ACH Direct Debit also uses the ACH network to process payments, is low cost, and offers a high level of security. And unlike Pay by Bank, ACH Direct Debit is widely established and recognized by American consumers.

In this post, we are going to look at some of the areas in which ACH Direct Debit and Pay by Bank are different, and what considerations merchants should take into account when deciding what payment method to offer.

1. The customer experience at the checkout (and beyond)

A key differentiating factor between Pay by Bank and ACH direct debit is with the customer experience at the checkout.

In the case of ACH Direct Debit, first, a merchant must request the consumer's account details and authorization for the payment. This can be through the completion of a paper form, verbally over the phone, or online. Following this, the customer gives the merchant permission to take the payment out of their account when it's due.

Merchants are also required to verify the customer. With ACH Direct Debit, this is often done through microdeposits. The merchant makes two small deposits of different amounts in the customer’s account, following which, the customer verifies the exact amounts. This is a way for the customer to prove they have access to the account they claim belongs to them. However it's extremely slow and inefficient.

With Pay by Bank, the process is much simpler. When making a payment online using Pay by Bank, the customer chooses “Pay by Bank” at the checkout, and is redirected to their bank's mobile app or online banking page to complete the payment. The payment is made using their regular bank account authentication. And for the verification process, customers simply need to verify their account by logging into their bank account, after which the merchant receives the account and routing numbers via an API response and webhook.

The ability to offer a simple, intuitive payments experience is better for customers and an enormous advantage for merchants. In fact, not only is Pay by Bank a simpler checkout experience than ACH direct debit, it is also simpler than card payments, for which customers need to input card information. This leads to improved conversion at the checkout, and increased revenue for businesses that sell online with Pay by Bank.

Winner: Pay by Bank

2. Recurring and subscription merchants

An important challenge for subscription and recurring merchants is how to reduce involuntary churn, which accounts for up to 48% of all customer churn for subscription businesses.

The “good” news for merchants is that almost all causes of involuntary churn are related to payment cards, and with both ACH direct debit AND Pay by Bank, there is no card involved in the transaction. This automatically removes the root cause of most incidents of payment failure, including lost, stolen, and/or expired cards.

Further, businesses that collect recurring and subscription payments with ACH Direct Debit value it because the process is automated, substantially reducing late and unsuccessful payments.

So what does that mean for merchants? According to Chargebee, subscription-based merchants that work with ACH Direct Debit have a payment failure rate of only 0.5% — orders of magnitude lower than cards.

Since it also runs over the ACH network, Pay by Bank also offers these exact advantages. But in addition, there are several more innovations on top of this that can provide compelling advantages for merchants. These include:

The superior customer experience at the checkout, as outlined above, which helps improve conversion.

Predictive analytics and smart retries further decrease the rates of involuntary churn for subscription merchants, even if there are insufficient funds.

Winner: Pay by Bank

3. Ease of integration

With ACH direct debit, there are two routes you can take to offer it as a payment method; integrating directly, or working with a payment service provider such as Stripe or Adyen. If you integrate directly, there is some complexity involved. Working with a PSP can reduce that complexity, but also comes with extra costs.

With Link Money - Pay by Bank, we have put a great deal of effort into making the merchant experience straightforward, secure, and easy to integrate, through the SDK and API, and where possible, take care to provide a seamless end customer experience as well.

For example, when we designed our SDK, we were obsessive about minimizing the amount of work that consumers of the SDK need to do to complete an integration. And where many B2B SDKs focus on the business customers consuming the SDK, we also took on the task of presenting a rich UI for the end customer as part of the SDK.

This approach means that whether you are talking about integration or designing a seamless customer experience, Pay by Bank has the edge.

Winner: Pay by Bank

4. The regulatory landscape

While regulations are starting to slowly move against BNPL, and there are occasional threats to enforce greater competition in the credit card industry (most recently through The Credit Card Competition Act) both Pay by Bank and ACH Direct Debit are unlikely to be affected by adverse regulations. In fact, the Dodd Frank “Open Banking Rule”, which proposes giving consumers the right to control and share their financial data, has the potential to boost the technology that Pay by Bank is built on. So while there are no regulatory clouds on the horizon for either Pay by Bank OR ACH Direct Debit, there is the potential for Pay by Bank to benefit from regulatory tailwinds.

Winner: Pay by Bank

4. Merchant fees

Merchant fees is a key selling point for both payment methods — vastly lower than cards and providing the potential for merchants to save substantial amounts of money. However, it is worth bearing in mind that with ACH Direct Debit, there may be some extra costs, depending on how you integrate.

For example, you may need to pay fees to your PSP, or add a verification solution to comply with Nacha rules, or think about a fraud and/or intelligent retry solution. Plus, if you integrate yourself, there may be some development costs in terms of time. It is likely that the simplicity of Pay by Bank will prove to be more cost-effective in the long run when you factor in the lower number of vendor relationships and conversion improvements that it offers.

Winner: Pay by Bank

The verdict: Pay by bank will suit most merchant use cases better than ACH Direct Debit

It is important to note here that ACH Direct Debit has many advantages over credit cards, BNPL, and wallets for certain use cases. However, it falls short in terms of the customer experience and ease of integration, and lacks a number of smart features that merchants today expect, such as smart retries and account verification.

Therefore, while the payment rails are the same for both payment methods, you can think of Pay by Bank as an intelligent version of ACH Direct Debit, combining its advantages with those of other digital payment methods.

Furthermore, with Pay by Bank you are buying into not only today’s features, but what Link Money is building for the future — a constant stream of iterations and updates to create an even more compelling payment method for merchants and customers alike.

To find out more, contact us.