Use Case

POS with Dynamic Links - Medical Practice Case Study

September 11, 2024

Narciso Munoz Legarre

This document evaluates the feasibility of using Dynamic Links as a payment product in the POS space, based on a joint study with a dental practice operator in Central California. The implementation resulted in a 37.5% reduction in overall payment processing costs.

Background

The POS payment space in the US is dynamic, with new technology companies offering merchants more payment options and easier management. Despite this, high processing fees remain a significant pain point, especially for merchants with niche operating platforms who struggle to secure competitive rates. The integration of Dynamic Links by Link Money aimed to address this issue by reducing costs while maintaining a positive customer experience.

Dynamic Links Overview

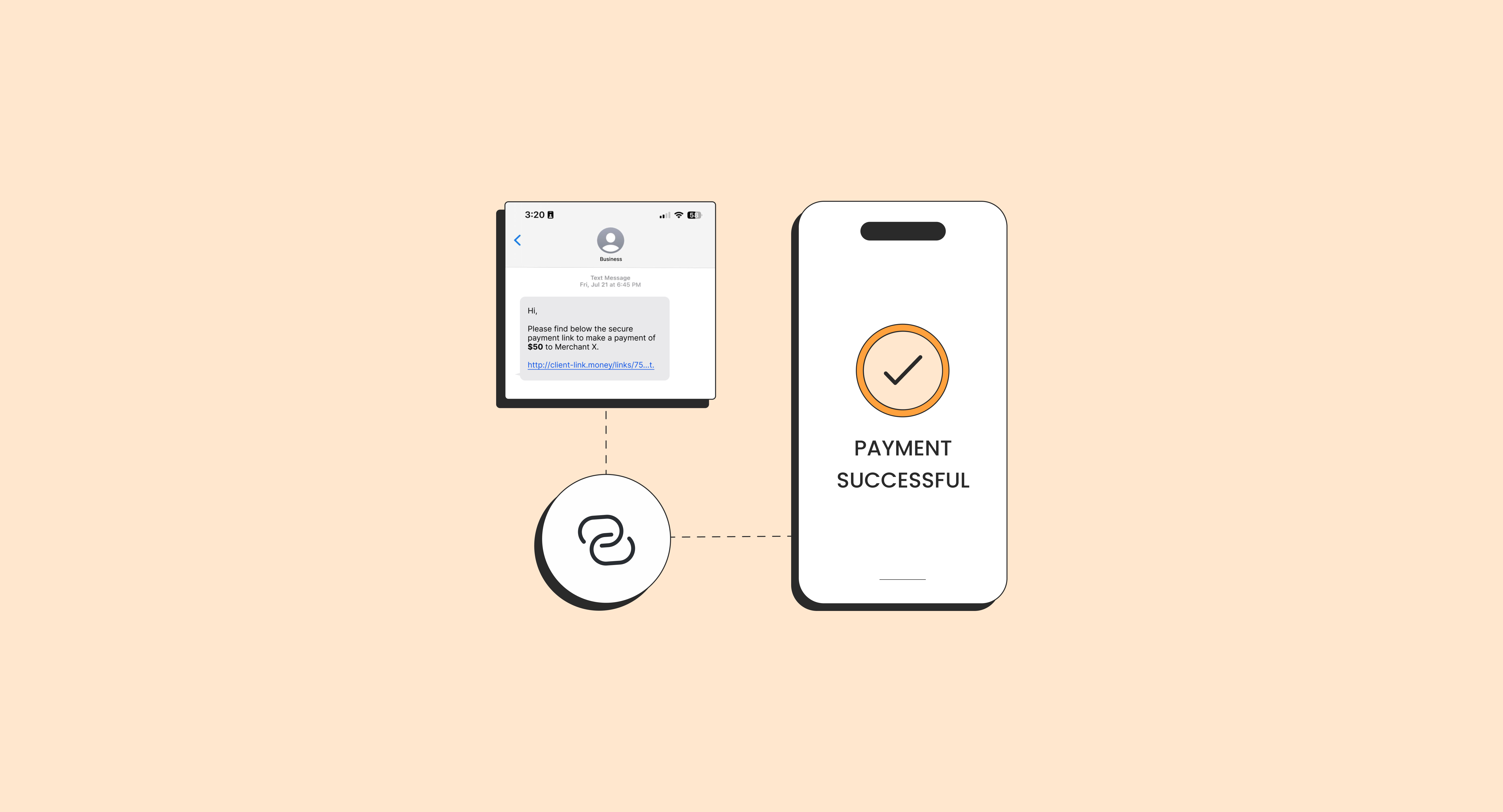

Dynamic Links is a no-code payment solution that enables merchants to generate and share payment links via SMS and email. Designed for simplicity, it can be implemented without coding, or with a simple API for further automation. The dental practice chose a no-code implementation, avoiding the need for engineering resources. The Pay by Bank pricing for transactions via Dynamic Links was 60-75% lower than their existing platform’s traditional methods.

Implementation

The existing system at the dental practice collected payments over the counter, with a payment split of 67% cards and 33% cash. The primary goal was to reduce card spend without impacting revenue or labor schedules.

Challenges and Solutions:

Integration without Burdening Employees: Link Money provided training and support, enabling staff to systematize the payment process after three one-hour sessions. This included steps for link generation, email delivery, and reporting alongside cash transactions.

Client Adoption without Revenue Impact: The practice displayed a Pay by Bank brochure and verbally offered it as a payment option, emphasizing cost savings

Results

After six months, the revenue split was 33% cards, 33% cash, and 33% Pay by Bank via Dynamic Links, leading to a 37.5% reduction in processing costs. The first month saw five support calls, decreasing to one call by month three. The practice maintained its legacy system alongside Dynamic Links with no changes in staffing or notable impacts on revenue or customer satisfaction.

Conclusion

Key takeaways include:

Merchants can reduce processing fees without altering their operational structure or migrating platforms.

Customers are willing to adopt alternative payment methods when encouraged by merchants, particularly in loyalty-driven sectors.