Blog

Quality considerations when testing fintech products

December 5, 2023

Mili Shrivastava

Due to the unique challenges and critical nature of financial systems, testing fintech products demands a specialized set of quality engineering skills and expertise. This post explores the skills needed and challenges endured by QA in Fintech.

Quality Considerations

Here are the key areas of focus for quality in testing fintech products:

Automation Testing:

Automate testing for every feature with a goal to be able to test the entire system with a click of a button, as automation provides effective regression test coverage and rapid feedback for all changes.

Continuous Integration and Testing:

Integrate testing into the continuous integration/continuous deployment (CI/CD) pipeline to maintain a seamless development process.

Functional Testing:

Transaction Flows: Thoroughly test end-to-end transaction processes to ensure accuracy and reliability.

Integration Testing: Validate seamless integration with external systems, such as banking platforms or payment gateways.

User Experience (UX) Testing:

Intuitive Design: Evaluate the user interface for clarity, simplicity, and ease of use to enhance the overall user experience.

Accessibility: Ensure the product is accessible to users with diverse needs, including those with disabilities.

Security Testing:

Data Security: Evaluate the robustness of encryption methods, ensuring the protection of sensitive financial data.

Authentication and Authorization: Verify the effectiveness of user authentication processes and authorization mechanisms to prevent unauthorized access.

Regulatory Compliance:

Understanding Regulations: Stay abreast of financial regulations and ensure that the fintech product complies with industry standards and legal requirements.

Audit Trails: Implement and test audit trails to facilitate regulatory audits and compliance reporting.

Performance Testing:

Scalability: Assess the system's ability to handle increased loads, especially during peak times or unexpected high demand.

Response Time: Measure and optimize response times to ensure quick and efficient user interactions.

Data Quality and Integrity:

Data Validation: Verify the accuracy and integrity of financial data processed by the system.

Error Handling: Assess the system's ability to handle and recover from data-related errors without compromising integrity.

Mobile Testing:

Cross-Platform Compatibility: Ensure the fintech product functions seamlessly across various mobile devices and operating systems.

Collaboration and Communication:

Interdisciplinary Collaboration: Foster collaboration between development, quality assurance, and other stakeholders to ensure a holistic approach to quality.

Effective Communication: Clearly communicate testing results, issues, and potential risks to stakeholders.

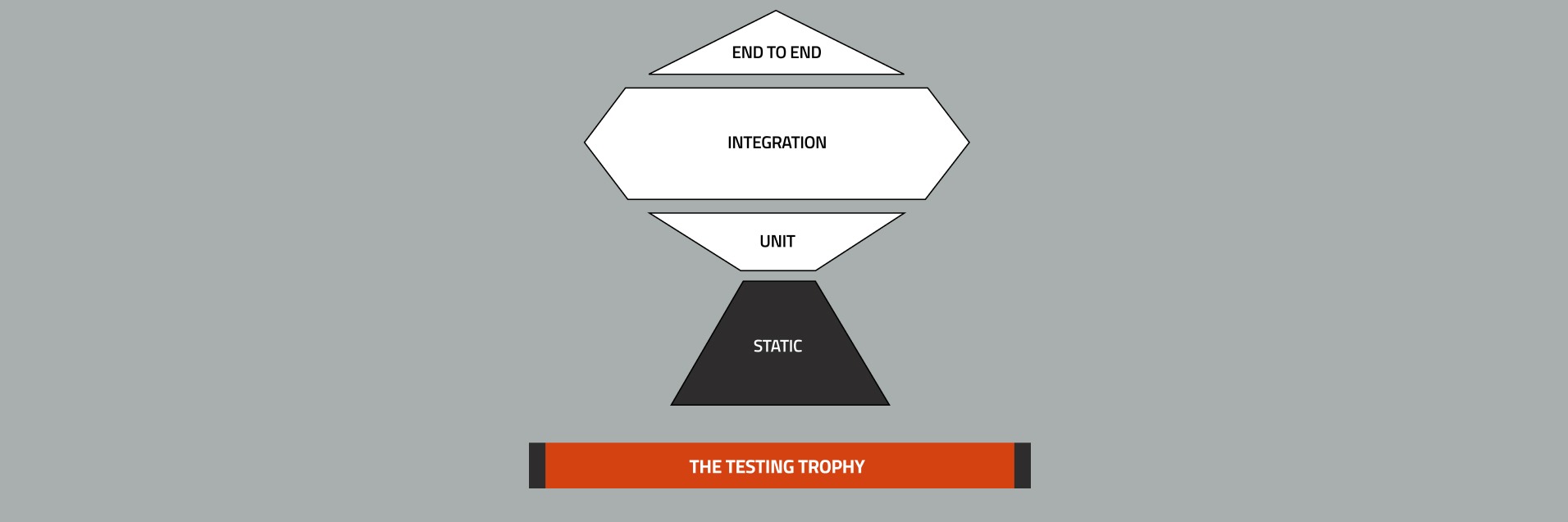

While “The Test Pyramid” has been the long accepted standard for test strategy, the “Trophy Model” is more appropriate for fintech products. This model adheres to the “shift left” philosophy in testing and encourages better balance among various types of testing depending on the needs of the feature.

Challenges for Quality Engineering in Fintech

Quality Engineering in the fintech landscape presents a multitude of challenges. Managing intricate software connections and third-party integrations within complex ecosystems necessitates thorough testing. The rapid pace of technological advancements underscores the need for agility and agile adaptability. Furthermore, the ever-looming specter of security threats, such as cyberattacks, mandates continuous vigilance. Some of the key challenges are as follows.

Production testing: Fintech products interact with real financial institutions that operate on real money. Any kind of automation on such institutions, without explicit permission, is illegal, unethical, and a serious violation of security. We address this by simulating these financial institutions in lower environments as close to reality as possible by using various mocking and other techniques.

Staging Environment: Testing in a development or staging environment might not fully replicate the conditions of the production environment. If possible, test in an environment that closely mirrors the production setup. Communicate with the third party to ensure consistency across environments. Lot of time rate limits are the biggest hurdle for any testing. To overcome this we have to be creative and use a mock server to simulate the third-party API's responses. This allows testing to proceed even when the actual API is not accessible.

AI/ML: Modern fintech systems increasingly rely on Artificial Intelligence to make decisions. Testing AI/ML systems is an evolving field of engineering that requires a steep learning curve and creative thinking. Preparing test datasets and identifying success criteria are complex new paradigms for QA. This testing can only be achieved with close collaboration with the ML dev team.

Accuracy: While a product working accurately as it was defined is a requirement in any industry, this is even more important for a fintech product where the losses from a product bug can be very high. To ensure high accuracy of the product, in addition to usual thorough testing, special attention is paid to edge cases. We implemented a process where Product, Development and Engineering teams come together to identify every last possible scenario that can occur in the field and make them part of the test plan.

Performance: Any product is expected to perform to provide optimal user experience. However, this becomes a particular challenge in products that rely on multiple third-party integrations to provide features. Such reliance on third-parties is a common architecture choice in fintech products. Key to achieving performance is measuring it and identifying bottlenecks. We implemented ways to test performance of various parts of the system by mocking various components and third-party interfaces. Once bottlenecks are identified, it’s a matter of addressing internal inefficiencies or enforcing SLAs on third-parties.

What’s in it for the Quality engineer?

High-demands of fintech testing also offer high rewards. They provide an opportunity for a Quality Engineer to grow and hone their craft. Some of the key areas of learning in a fintech company:

Problem Solving: QA often involves identifying and solving complex problems. This can be intellectually stimulating and satisfying, especially when you find creative solutions to challenging issues.

Continuous Learning: The technology and methodologies in the software and quality assurance industry are constantly evolving. For individuals who enjoy learning and staying up-to-date, QA offers a dynamic environment.

Contributing to Quality: QA professionals play a vital role in ensuring that products or services meet high standards. Knowing that your work directly impacts the quality of the end product can be rewarding.

Team Collaboration: QA often requires close collaboration with developers, designers, product managers, and other stakeholders. Working in a team and contributing to the success of a project can be fulfilling.

Variety: QA can involve a variety of tasks, from manual and automated testing to process improvement and documentation. This diversity can keep the job interesting and prevent monotony.

Advocating for Users: As a QA professional, you often advocate for the end-users and their needs, which can feel purposeful, knowing that your work benefits people.

Continuous Improvement: QA often involves a commitment to continuous improvement and the pursuit of excellence. If you enjoy striving for perfection and making incremental progress, this can be fulfilling.

Recognition and Impact: When your work results in better quality and fewer defects, it's often recognized and appreciated by your team and organization, making you feel valued.

Job Satisfaction: Knowing that you are helping to prevent defects and improve the user experience can be a source of job satisfaction.

It's important to recognize and appreciate the aspects of your job that bring you joy and satisfaction. When you genuinely love your work, it can lead to a more fulfilling and successful career.