Blog

Push vs Pull: What are the differences between push and pull payments?

July 19, 2023

Editorial Team

Every day, millions of transactions occur worldwide. In 2022, the number of cashless transactions reached 989.4 billion and is expected to rise to 2,121.6 billion by 2026. Among these transactions, the majority are push and pull transactions.

As the world increasingly embraces digital transactions, it’s important to understand the distinctions between these two transaction types so we can choose the best payment method that suits our purpose. In this article, we’ll explore the definition, examples, and differences between push and pull payments; keep reading to learn more.

What are push payments?

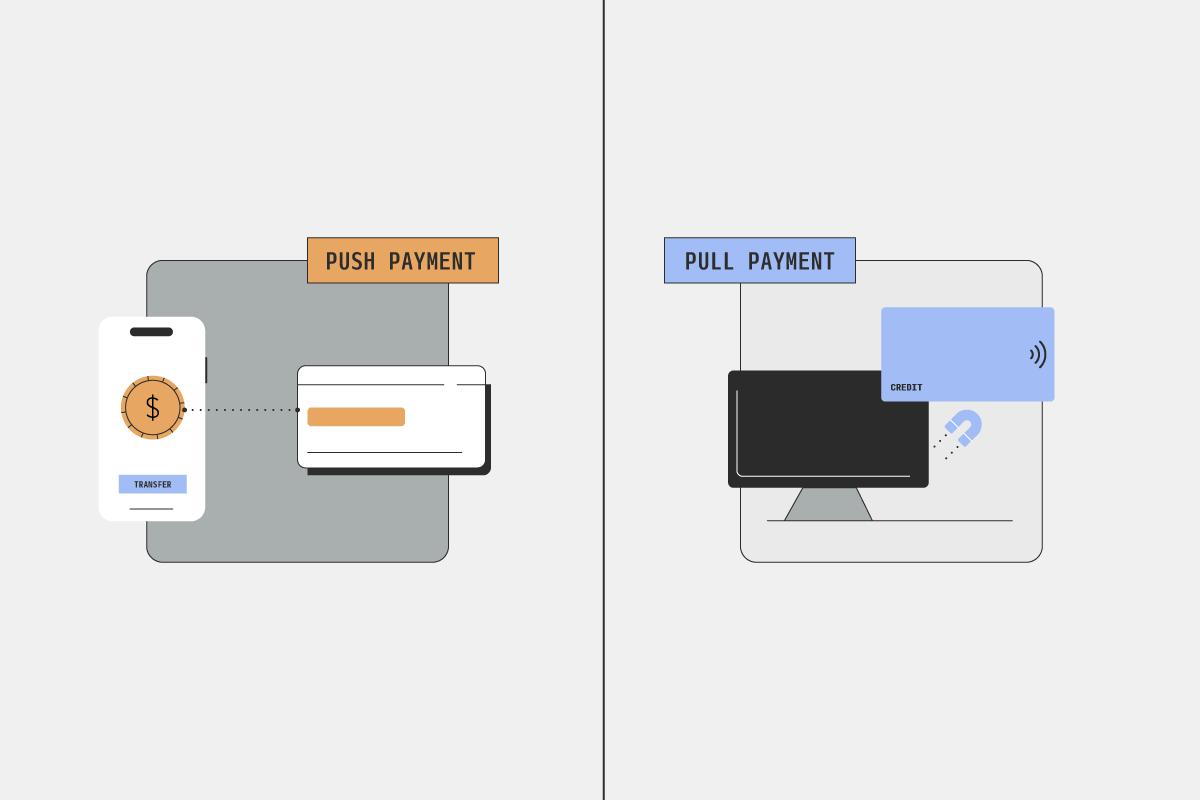

In a push payment, the payer takes the initiative to send money to the payee. This means that the payer has full control over the payment, including the amount of money being sent, the recipient of the payment, and the timing of the payment.

Push payments provide merchants quick access to funds, enabling faster access to working capital; this is especially valuable for small businesses with tight cash flow needs. Additionally, they streamline payment processes, eliminating the need for manual invoicing or collection efforts and improving operational efficiency. There are several kinds of push transactions; an example includes paying an invoice.

Push payment process

Push payments are quite common in everyday transactions, and are particularly popular in digital transactions. Typically, a push payment process involves five steps:

Payer initiates payment: The payer provides the necessary details to initiate the transaction through a banking app, payment platform, or website.

Payer authorization: The payer confirms the amount, recipient, and additional information to approve the transfer of funds.

Payment processing: Once authorized, the payment service provider deducts the specified amount and prepares to send it to the payee.

Fund transfer: The payment service provider transfers the funds from the payer's account to the payee's designated account, either instantly or within a specified time frame.

Payment confirmation: After the fund transfer is complete, both the payer and payee receive confirmation of the successful payment through notifications, email receipts, or transaction history updates.

Throughout the payment process, the payer has the power to modify or cancel the transaction before it’s complete. Examples of push payments include the following:

Direct deposits: When you receive a direct deposit like your paycheck or tax refunds, that is a push payment initiated by your employer or the government.

Peer-to-peer (P2P) transfers: Sending money directly to friends or family using a payment app like Venmo or Paypal is a push payment. You initiate the transaction, specify the amount, and provide recipient details.

Bank transfers: Transferring money between bank accounts using online or mobile banking is a push payment. Examples include Zelle, bank transfers, and Interac (in Canada).

Cash: Paying cash to anyone is a push payment. You initiate the transfer of money by choosing the amount and initiating the transaction.

However, push payments have some downsides. In some cases, they’re more susceptible to fraud, like with cash theft or loss. Think of it this way, once the payment has been pushed out, there isn’t a way to rein it back in. Additionally, incorrect or insufficient payment details can lead to failed or delayed transactions, affecting cash flow predictability.

What are pull payments?

In contrast, a pull payment is when the payee requests the payer to send the money. Here, the payee has control over the payment and requests the funds. However, the payer must provide authorization for the funds to be debited. Once the transfer has been authorized, the payer can’t modify or cancel the transaction as easily once it’s begun processing.

Pull payments are extremely beneficial to merchants. For example, pull payments can automate recurring payments, providing convenience. Merchants can set up automatic debits from customers' accounts for subscription-based services or recurring billing, saving time and effort on manual collection. Because of these recurring payments, pull payments improve cash flow predictability, enabling better financial planning and forecasting.

Pull payment process

Although the exact steps and processes involved in a pull payment may vary depending on the financial institution and the payment method chosen, there are generally five steps involved in pull payments:

Authorization: The payee obtains the necessary authorization from the payer to initiate the payment, including consent and payment details.

Payment instruction: The payee creates a payment instruction using the authorized payment information, specifying the amount, account details, and other relevant transaction information.

Payment initiation: The payee sends the payment instruction to the payment service provider or financial institution to initiate the payment, triggering the debiting of the payer's account and transferring funds to the payee's account.

Fund transfer: The payer's financial institution processes the payment instruction, debiting the funds from the payer's account and transferring them to the payee's designated account through systems like ACH.

Confirmation: Once the fund transfer is complete, both the payer and payee receive confirmation of the payment through transaction receipts, email notifications, or payment history updates.

There are numerous examples of pull payments:

Direct debit is a pull payment method where the payee authorizes the payer's bank to deduct funds from their account on a recurring basis for bills like utilities and subscriptions.

Automatic bill payments allow payers to authorize the payee to pull funds directly from their account for bills such as credit cards, loans, and mortgages.

Credit card payments where during an e-commerce checkout, customers provide their payment details to the merchant, who initiates a pull payment, deducting the purchase amount from the customer's account.

Mobile wallets like Apple Pay, Google Pay, or Samsung Pay enable users to link their bank accounts or cards to the app, which initiates a pull payment from the linked account during purchases.

Online payment gateways like PayPal, Stripe, or Square facilitate online payments by initiating pull payments from customers' accounts to merchants.

Ultimately, pull payments have fewer risks involved and can be advantageous to merchants, particularly when using an open banking-powered payment option like pay by bank, where transactions undergo more rigorous authentication measures to minimize instances of fraud. In the United States, pay by bank is a payment method powered by open banking, but it runs on Automated Clearing House (ACH) rails, similar to direct debit. Due to the payment rail, pay by bank is a pull payment that can also reduce the risk of chargebacks compared to push payments, minimizing disputes and fraudulent chargebacks that can result in significant losses to merchants.

Pull payments also reduce overhead. For example, with pay by bank, merchants wouldn’t have to deal with hefty transaction costs and hidden fees that come with credit card transactions. Moreover, pull payments enhance customer experience, as it leads to a smoother payment experience.

Push versus pull payments: a side-by-side comparison

Feature | Push payment | Pull payment |

|---|---|---|

Person in control | Payer | Payee |

Customer experience | Requires relatively more effort from the customer/payer | Seamless as there’s less manual work involved on both sides |

Cash flow predictability | Not as easy to predict as the payer is in control of the transaction | High, particularly with recurring transactions or subscriptions |

Recurring transactions | Not possible with individual authorization for each transaction | Possible |

Examples | Bank transfer, cash, peer-to-peer payments | Direct debits, online card payments, mobile wallets, and automatic bill payments |

Choose the right payment method for your business

Selecting the appropriate payment method for your business, whether it's push or pull, is key for optimizing financial operations. Understanding the differences and benefits of push and pull payments can help you make an informed decision that aligns with your business needs.

To learn more about how Link Money’s pay by bank can benefit your ecommerce business, contact us.